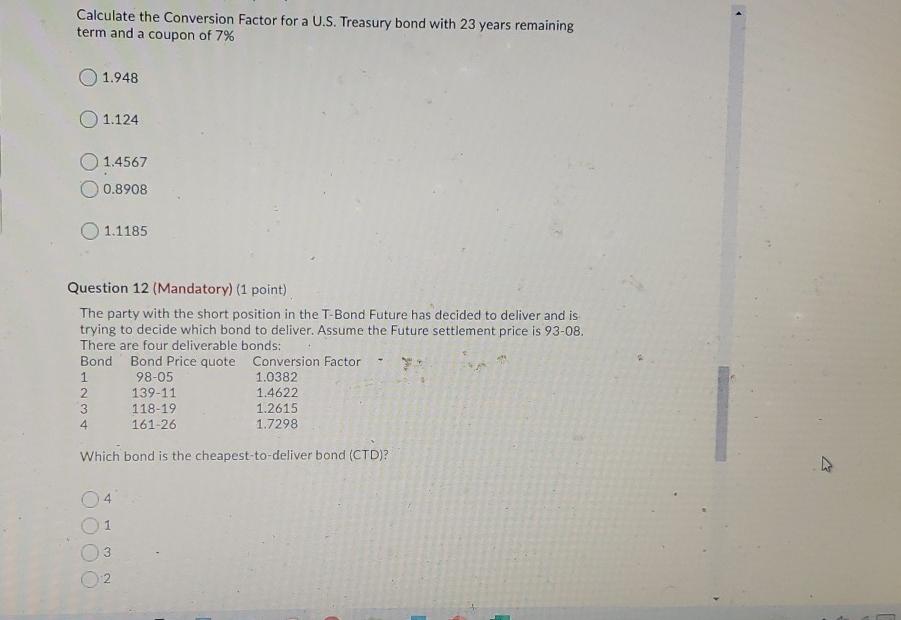

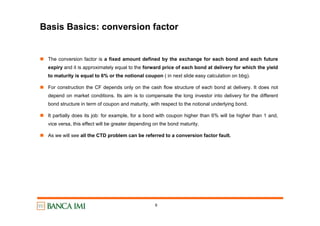

Lecture 11. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

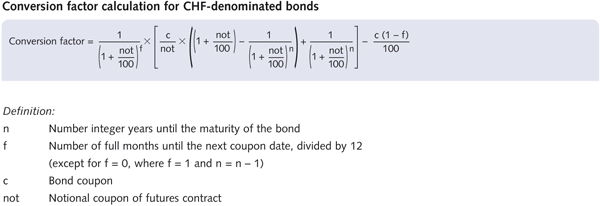

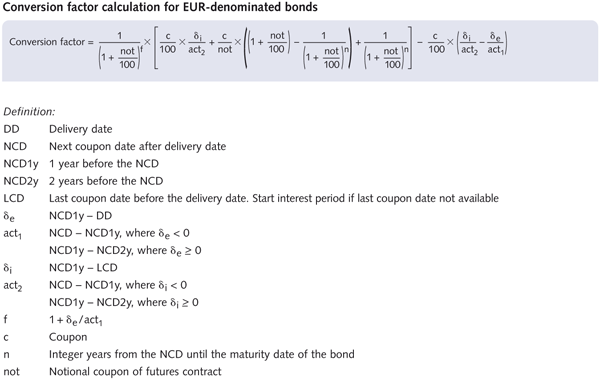

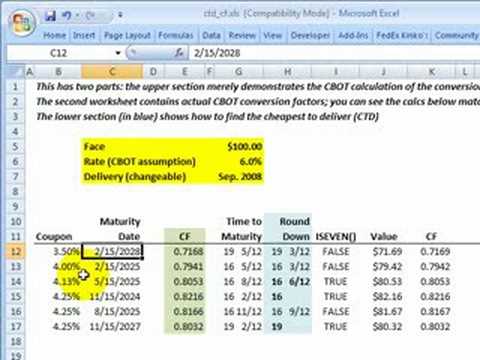

Intuition and reasoning behind conversion factor calculation for bond futures - Quantitative Finance Stack Exchange